Deutsche Bank – Too Big To Fail or Too Complex To Survive?

in News

Complexity and interdependency are the hallmarks of our time. The increase of complexity and turbulence in the markets and in the economy demands new approaches when it comes to making investments, running a business, strategy and governance. Excessive complexity is the source of fragility and exposure. In our view, it is the main threat to sustainability. Excessive business complexity and interdependency impacts its profitability, exposure and sustainability since it is a formidable source of:

• Inefficiency

• Fragility

• Ungovernability

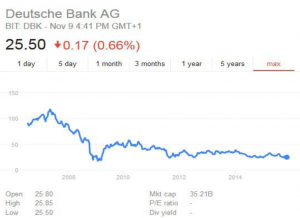

One example which confirms this is certainly the case of Deutsche Bank. It has embarked on a complexity reduction program (in order to “Transform its operating model to achieve higher efficiency, reduced complexity, better resilience and resolvability”). We hope it succeeds. The bank plans to slash 35000 jobs and reduce the number of (IT) operating system from 45 to 4! Deutsche Bank has reported a staggering cost/income ratio of 83.6% (Q1, 2015). The value of its stock, illustrated below, speaks for itself.

Source : Google Finance

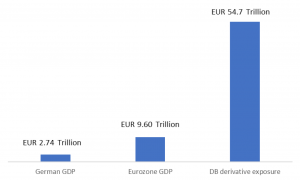

The bank is also sitting on a mountain of derivatives, 54.7 trillion Euros. That’s 20 times the GDP of Germany.

New CEO John Cryan said “We must reduce Deutsche Bank’s complexity“. We couldn’t agree more. If the complexity of this super-huge bank is not reduced, it will eventually spill over into the system, reducing its governability, resilience, sustainability.

A recently published article in Financial Times states: “Deutsche now has, for example, more than 100 different booking systems for trades in London alone, and has no common client identifiers. It has even been unable to retrieve some of the data requested by regulators — which contributed to its failure in this year’s US bank stress tests.”

Deutsche Bank is certainly Too Big To Fail but the problem is that it may also be Too Complex To Survive. In either case it is a big problem. For everyone. In the best of cases, it is surely very difficult to fix. Deutsche Bank may certainly be qualified as an Extreme Problem. Read here.

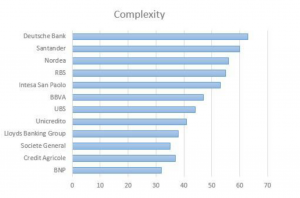

So, yes, we all agree that Deutsche Bank is very large, it is complex and it is a huge systemic bank. The question, as usual, is to measure complexity, not to talk about it. The point is: science, not opinions. Since we prefer to measure things before we speak, we’ve run a quick and dirty comparison of the complexity of a dozen large European Banks. The analysis has been based on Banking Ratios. Results are relative to Q1 2014. The complexity ranking is illustrated below.

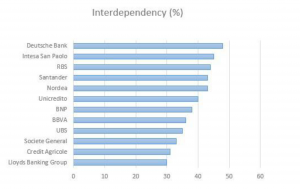

Deutsche Bank is not just the most complex, its business also has the highest degree of interdependency:

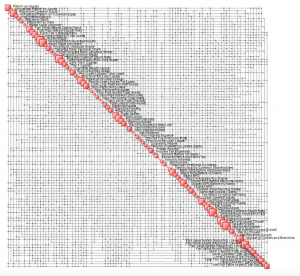

A look at its Complexity Map gives a better idea of what we mean by high interdependency:

Figure 1. Deutsche Bank Financial Statements Complexity map

Restructuring a business of this nature may not be easy and major surgery might be necessary. And, mind you, this is just a glimpse of the business based on Banking Ratios. A mere 100 parameters!

In reality there are thousands that one should take into account before sketching out a strategy. Cost reduction is fine but it is not necessarily synonymous of complexity reduction. In order to really reduce complexity and maintain it at desired levels one should monitor it on, say, quarterly basis. A one-off initiative, such as slashing jobs, is not a cure. Complexity reduction may be accomplished only if performed on a scientific basis. First of all, the main drivers of complexity should be determined and monitored. In the case of Deutsche Bank these are (based on Q1 2014 banking Ratios):

Figure 2. Deutsche Bank Financial Statements items ranked by complexity contribution

The contribution to overall complexity of each parameter is in percentage terms. In the case in question, the main driver of complexity is “Number of Outlets and Branches”, with a footprint of 2.5%. In other words, 2.5% of the complexity of DB’s business is due to “Number of Outlets and Branches” (again, based on Banking Ratios of Q1, 2014). The volatility of the main complexity drivers, once identified, should be reduced. It must be kept in mind that the above bar-chart (the so-called Corporate Complexity Profile) as well as the Complexity Maps, are not static, they change with time.

So, Deutsche Banks want to become less complex. It will start cutting jobs, redesigning its IT infrastructure, closing branches, withdrawing from certain countries, letting go of certain assets, etc. How will it know if it has indeed become less complex? This is how :

• Measure complexity before the complexity reduction program starts. This complexity is C_1.

• Measure complexity after the complexity reduction program has been completed. This complexity is C_2.

• Compute (C_2 – C_1)/C_1 X 100%. This is the complexity reduction ratio.

If the complexity reduction ratio is negative (and large enough) the program has been successful.

Science not opinions.