Consulting Services

MARKET-SPECIFIC EARLY-WARNING SIGNALS

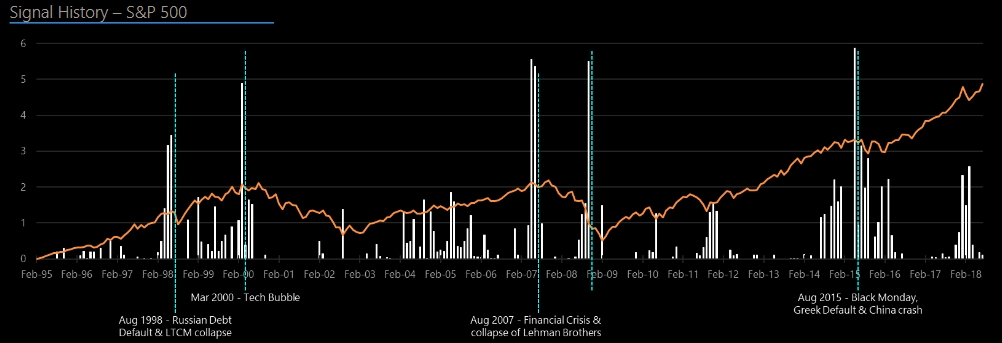

Complexity analysis of macro-economic indicators offers an efficient early-warning signal producing sharp spikes prior to major market drops. This is key in establishing efficient shorting strategies. The approach has been tested in various industry sectors, in which access to early warning signals is crucial.

An example is illustrated below. Vertical white spikes represent complexity-based signals.

SYSTEMIC PORTFOLIO ANALYSIS

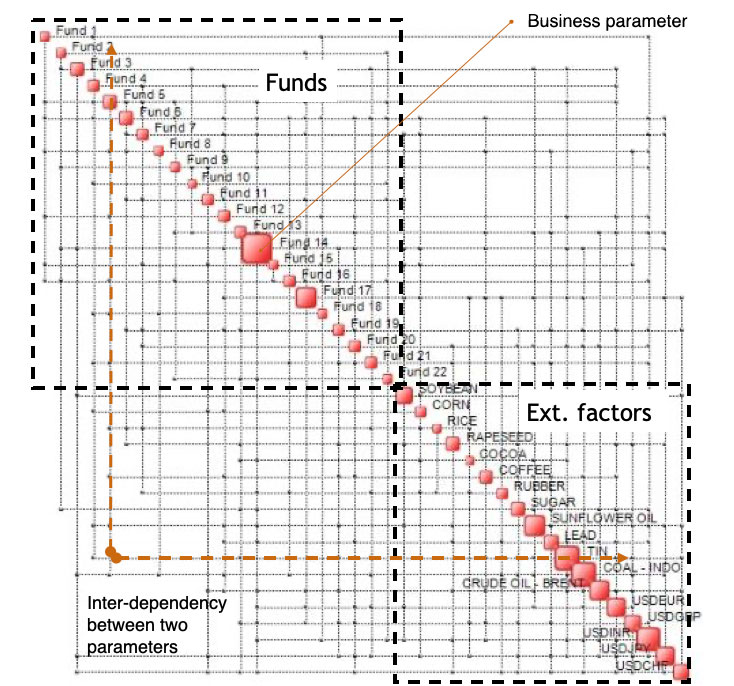

Integrated Systemic Portfolio Analysis includes external factors (macro-economic parameters, interest rates, unemployment, GDP growth, currency exchange rates, etc.) when it comes to determining the real exposure of complex portfolios funds or systems of funds. In essence, a portfolio or a fund is analyzed together with its ‘ecosystem’ in an integrated fashion, so that its interaction with the economy is taken into account.

An example of a Complexity Map of a system of funds is illustrated here.

COMPLEXITY AND RESILIENCE RATING OF ASSETS AND CORPORATIONS

Complexity and Resilience rating is based on the following rationale:

Excessive complexity is a formidable source of fragility and vulnerability. Complexity-induced risk is a huge problem. It makes things fragile.

The economy is punctuated by crises, bubbles and destabilising events. In addition, it is characterised by turbulence and volatility. In such a context it is often more important to know what not to do. Wealth preservation is often more important than sheer performance.

Inexperienced investors should stay away from complex assets or businesses.

Universal Ratings provides unique information: a quantitative breakdown – a sort of a ‘CAT scan’ – of the complexity of a stock universe, a market sector or ecosystem of companies.

For more information, visit website

MEASURING SYSTEMIC RISK OF TRADING DESKS

Optimum offers a futuristic risk-assessment methodology which goes beyond traditional models used by risk managers. A typical application is drawdown early-warnings in Trading Desks. Systemic risks are determined taking into account large amounts of information such as Balance Sheets of thousands of companies, market indices, macro-economic indicators. Such information reveals new broad-scope and broad-scale insight into the structure and dynamics of risk.

Systemic risks in the global financial system are determined via our Financial Complexity Indices. These proprietary signals are computed based on major indices of each region. Examples are illustrated below.