About Us

Optimum is a London-based asset management firm whose investment strategies are based on a quantitative complexity management (“QCM”) approach to financial markets.

Quantitative Complexity Theory (“QCT”) was created in 2003 by Ontonix and Optimum co-Founder Dr. Jacek Marczyk.

QCT has been successfully applied by leaders across various industries through the company, Ontonix.

In 2015, the world’s first complexity standard, UNI 11613 “Business Complexity Assessment“ was introduced. In 2018 the ISO 22375 “Security and Resilience – Guidelines for complexity assessment process” was published.

In 2018, Ontonix jointly with SAIC, a large US DoD supplier, developed the first “Complexity Chip“, designed to monitor mission-critical equipment.

The Quantitative Complexity Theory helps view risk, volatility and portfolio design in a new light.

Complexity metrics provide superior market early-warning signals.

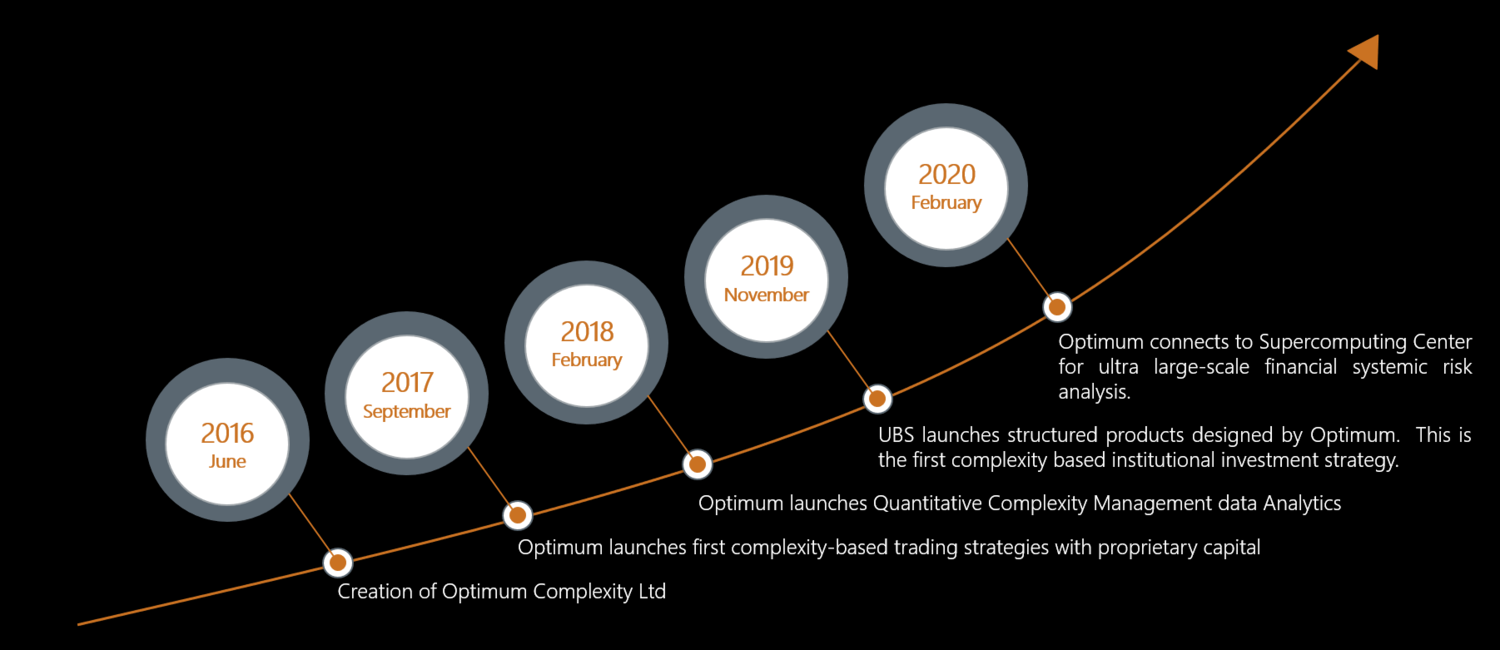

Optimum's History

Optimum's Competitive Advantage

The world is becoming more complex and less resilient. It is currently five times more complex than in the 1980’s. (Source: Using 260,000 separate parameters of the World Bank’s 2016 data, we have measured the evolution of complexity of the World as a system through the software Ontonet)

Proven Technology

QCT was developed by Optimum Co-founder Dr. Jacek Marczyk in 2003. US Patent awarded in 2009, adopted in various industries.

Experienced Team

Team with 65 years of investment experience.

First Movers

First Mover Advantage measuring systemic risk.

Unique Approach

The only company in the world to measure complexity using a proven model-free approach, and to launch complexity-based investment strategies.

Proven Results

Proven technology in several industries, with numerous clients. New methodology of portfolio design with a proven track record.

About Complexity

The world is becoming more complex and less resilient. It is currently five times more complex than in the 1980’s. (Source: Using 260,000 separate parameters of the World Bank’s 2016 data, we have measured the evolution of complexity of the World as a system through the software Ontonet)

Growing uncontrolled complexity is a major threat to all businesses and the global economy. In a world dominated by turbulence and interdependency, fragility and complexity are the main factors impacting financial performance. Complexity is a fundamental physical property of any system, measured in cbits. Complexity is defined as a function of the structure of information flow and entropy, within a system.

The QCM’s (Quantitative Complexity Management) measure has origins in quantum mechanics, systems theory and image analysis. It requires no models and accounts for the nonlinearities and dispersion of data using entropy concepts, not standard deviations.

Quantitative Complexity Management has been successfully used by banks, financial institutions, as well as companies from sectors such as medicine, defence, aerospace, automotive as well as business intelligence.